Top 3 Myths About Divorce

May 2, 2019What Is a Living Will?

June 14, 2019In this digital age, almost all adults have at least one social media or digital account and most have many more with the average being around 15. That may seem like a high number, but once you add in email accounts, Dropbox accounts, separate accounts for business or spam, etc. it is easy to see how quickly they add up. When considering talking to an attorney about a comprehensive estate plan, it is important to make sure your digital assets and accounts are handled appropriately

Do I own my Social Media Accounts?

Digital assets such as blogs, social network accounts, domain names, and other online accounts typically do not pass through traditional probate as they are not considered “property.”

Generally, the website who creates the platform owns your account and you have the ability to use it through a license. This is what you didn’t read about when you “accepted” the terms and conditions of the service provider’s contract. For example, when you buy a song off of iTunes, it is yours, and yours solely because you have paid for a license to listen to it. When you pass away, that digital right does not get passed down, it is terminated. This means the license to download it is only allowed to your account.

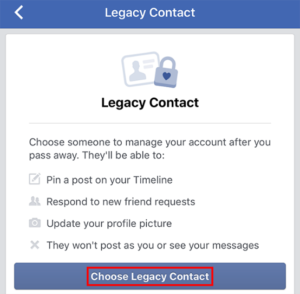

Every website handles death differently. Facebook allows you to appoint a friend or family member as a “Legacy Contact” to take control of your account after your death and set your page up as a “memorial” page. You also have the option of allowing a friend or family member access to a downloadable archive of all photos, posts and profile information you have shared over the years. As sort of a social media memento for their use and enjoyment.

Instagram requires proof of death like an obituary. Once received Instagram secures the account as is and provides the opportunity for a memorialized page as well. However, the company has a firm policy against providing log in credentials out of respect for the deceased’s privacy.

In order to remove an account, the list of documents and directions grows. First you must be a “Verified Immediate Family Member” which you can prove to them using a Birth or Death certificate, or a Power of Attorney for Finances, an essential estate planning tool.

LinkedIn only offers the ability to close a user’s account once they have passed away. Anyone may request that a profile be taken down from LinkedIn, but they must provide identifying information about themselves and the deceased for authentication. This policy is specifically important if the deceased was a member of a business who may have valuable contacts on LinkedIn, such information should be collected and exported prior to the accounts deletion.

Contact an Estate Planning Attorney

If you have a social media account that you want handled according to your wishes upon your death, contact an estate planning attorney for a consultation.